Life Stage Model

New Life Stage Model To Better Protect Your Retirement Savings

The Fund is introducing a default investment risk reduction program (i.e. a “Life Stage Model”) where the investment risk reduces as a member gets closer to retirement.

What is a Life Stage Model

Life Stage is a process whereby your fund credit is invested in line with your age profile and the number of years remaining until retirement. As you approach retirement, the investment risk is gradually reduced through a method called phasing. This ensures that the fund credit accumulated over the years is better protected, thereby reducing the impact of market volatility based on your age band.

How the Life Stage Model works

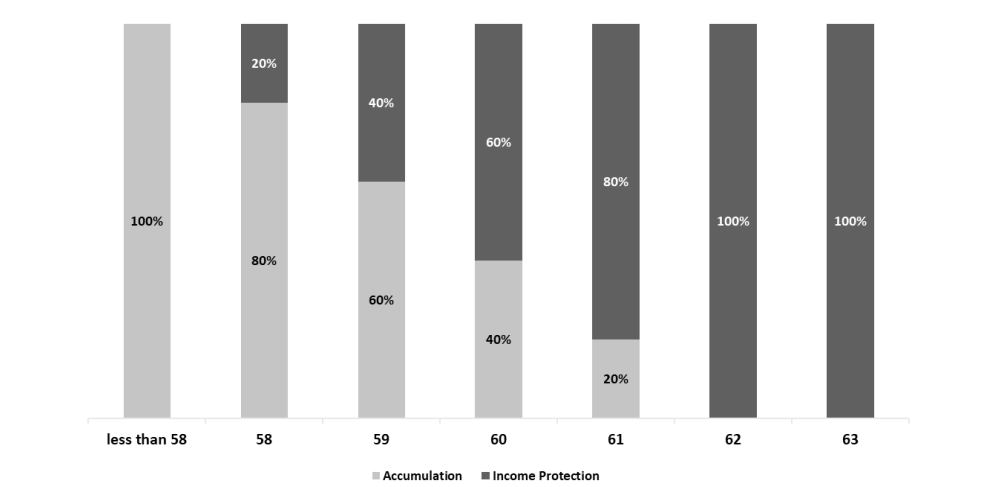

Life Stage is a process whereby a member’s assets are invested in a risk appropriate portfolio according to the member’s age and how many years are left until retirement. As the member moves closer to retirement, their fund credits are phased from a growth (Accumulation) portfolio (with more investment risk), into a conservative (Income Protection) portfolio (with much less investment risk).

The following graph below indicates how your fund credit will be switched until retirement age (63).

Click on the Frequently Asked Questions for further information