LSM FAQ

Life Stage Model FAQs

1. What is this Life Stage and how does it affect me?

Life Stage is a process whereby your fund credit is invested in line with your age and the number of years remaining until retirement. As you approach retirement, the investment risk is gradually reduced through a method called phasing. This ensures that the fund credit accumulated over the years is better protected, thereby reducing the impact of market volatility based on your age band.

The Life Stage approach balances growth and risk by adjusting your investment strategy based on your age. When you are younger, investments are more aggressive to maximize growth potential. As you approach retirement, the strategy will focus on conservative investments to protect your accumulated savings. Comprehensive details of this strategy, including the Life Stage process, are outlined in the Fund's Investment Policy Statement, which explains how your investments are managed and the guiding principles behind these decisions.

2. Why is the model being introduced now?

The Life Stage Model was introduced to comply with Default Regulation 37 of the Pensions Fund Act, which requires the Fund to provide members with a default investment strategy for members, and one which is appropriate for all the members of the fund. This model automatically adjusts investment risk based on a member's age, phasing from higher-risk growth assets when young to more conservative investments as retirement approaches.

The Life Stage Model also complements the broader objectives of the Two-Pot Retirement System by helping members manage their long-term retirement savings. Overall, the Life Stage Model aims to improve retirement outcomes by offering a structured, risk-adjusted investment approach that aligns with regulatory requirements and the best interests of the members.

3. How does Life Stage work?

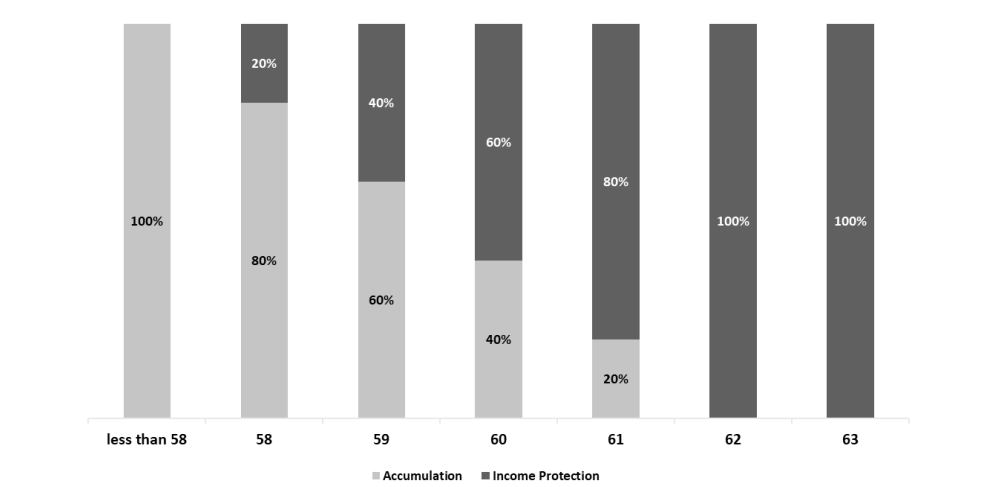

Life Stage is a process whereby a member’s assets are invested in a risk appropriate portfolio according to the member’s age and how many years are left until retirement. As the member moves closer to retirement, their fund credits are phased from a growth (Accumulation) portfolio (with more investment risk), into a conservative (Income Protection) portfolio (with much less investment risk).

The following graph below indicates how your fund credit will be switched until retirement age (63).

4. Why should I worry about the volatility in the market and my retirement?

As you know, MWPF is a defined contribution fund, meaning that the value of a member’s fund credit is determined in part by how the investment markets have moved. If the markets have moved up, then a member’s fund credit would generally have also moved up. Similarly, if markets have fallen, then a member’s fund credit would also have moved down.

As such, members are greatly impacted by the state of the financial markets and having the correct investment strategy in managing this risk.

5. When will the Life Stage Model be implemented?

The targeted implementation date is 01 July 2025; however, roadshows will be conducted before the implementation for members to get more understanding of the revised investment strategy.

6. Do I need to do something?

NO, as a member you don’t need to do anything. On the day of implementation, your fund credit will be phased in line with your age profile.

7. When will the phasing happen?

Annually on your birthday month, your fund credits will be phased in line with your age profile starting from age 58 years.

8. Can I opt-out during the year?

No, MWPF’s default investment strategy is the Life Stage Model designed to maximise the long-term retirement outcomes for all members and as such the Fund does not have Member Investment Choice.

9. Is there a cost?

NO, there are no direct costs for members being phased in line with your age profile as per the Life Stage Model.